We track millions of public records — lawsuits, defaults, liens, equipment loans, and UCC filings — across 32 states. From that data, we flag solvent businesses showing early signs of distress and introduce them to you before the market even knows they exist.

This channel is built to connect you with businesses serious about saving their future, not shopping around.

You meet businesses months before competitors even know they're on the market.

It doesn't replace your current marketing - it adds a reliable channel that delivers predictable, stabilizing results.

Get consistent, qualified introductions that supports steady growth.

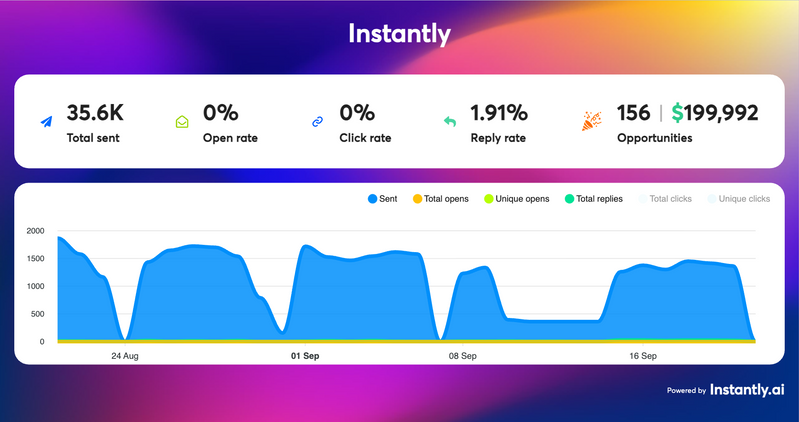

Helped them get 130 meetings with businesses struggling with MCA debt in 30 days, over $200k in new billings.

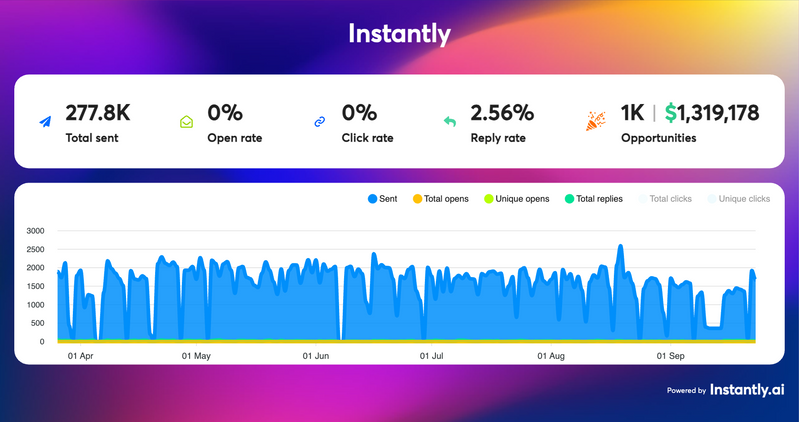

Connected them with 794 distressed business in just 12 months for MCA and vendor debt settlement consultation.

Closed over twelve 6-Figure Cases within 5 months

From the first sign of distress to a signed client

We track millions of public records — lawsuits, liens, defaults, and UCC filings — across 32 states. On top of that, Each business is scored on real warning signs, like losing staff too fast or hiring someone to handle money problems.

We track every sign of trouble.

We connect with flagged businesses to learn what debt they're facing and if restructuring makes sense for them.

We double-check each case so you only meet businesses that are real, solvent, and worth your time.

We connect you with these businesses before anyone else even knows they're in trouble.

The big advantage isn't only less competition, these businesses also move faster when your offer makes sense, because they're not being spammed by 10 other vendors.

You step in to help these businesses restructure. Since they're solvent and serious, deals close faster and smoother.

It's easier to sell water to a fish than win a business who's already talking to 10 other vendors — unless you want to play the 'we're cheaper' game.

That's why we make sure the businesses you talk to are only talking to you. They're not distracted or chased by others — and that's only possible if we find them early.

We reach them before bankruptcy is even on the table.

They aren't being spammed by 10 other vendors.

They want help and are ready to move forward fast.

We'll walk you through how we find solvent businesses at the first sign of distress and see if it's a fit for your company